28 September 2025 | Sunday | Analysis

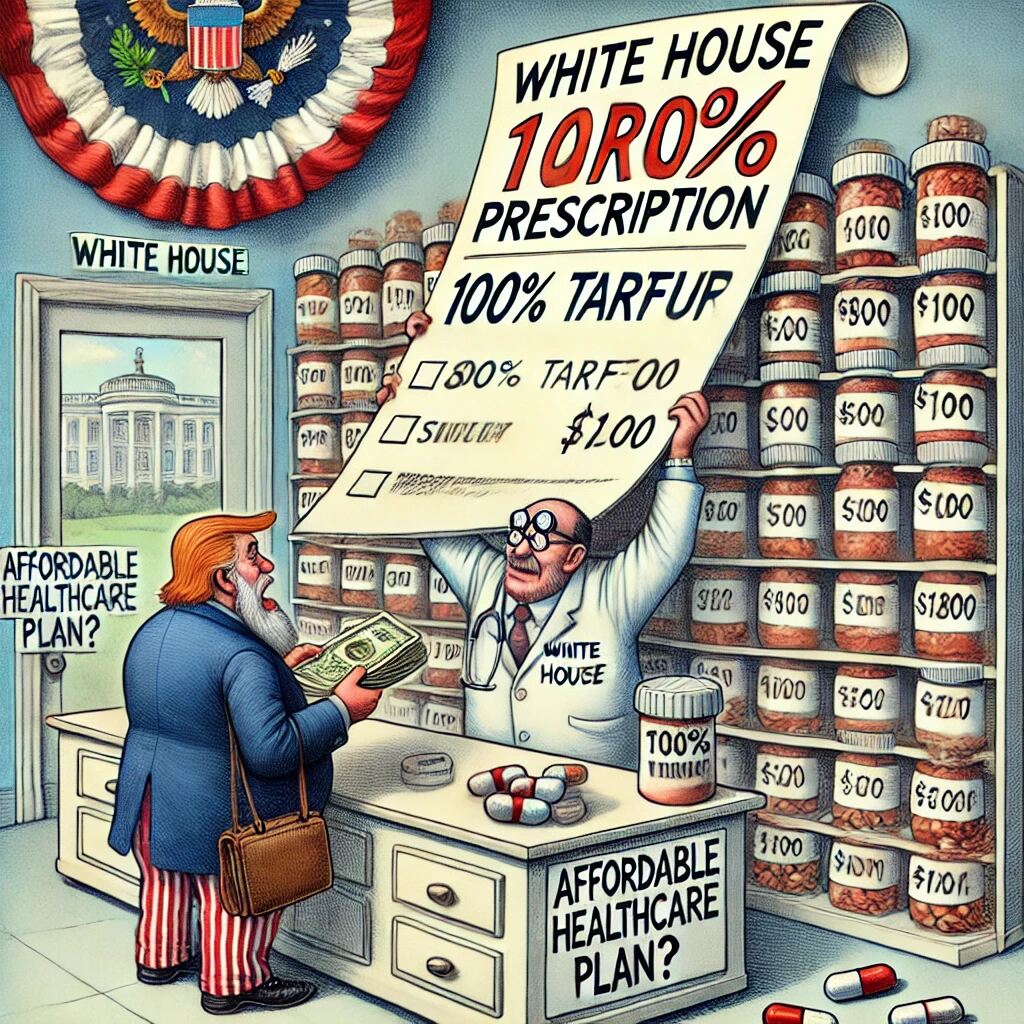

US President Donald Trump has announced a 100% import tariff on all branded or patented pharmaceutical products, effective 1 October. The steep duty will double the cost of imported brand-name medicines at the border, a shock to an industry deeply integrated with global supply chains. Mr Trump declared that companies can escape the tariff only if they are actively building drug manufacturing facilities on American soil. “I’m putting a 100% import tax on pharmaceutical drugs unless the companies are building plants right here in the United States,” he wrote on his Truth Social platform, adding that firms “breaking ground [or] under construction” on US factories will face “no exceptions”. Under this policy, any pharmaceutical maker that has not started domestic production projects will see its US-bound patented drugs hit with a punitive tax.

According to the White House, this measure aims to spur domestic manufacturing and reduce reliance on foreign-made medicines, framing it as a matter of economic security. The tariff was unveiled alongside new levies on other imports – including a 25% tariff on heavy trucks and a 50% duty on kitchen cabinets – as part of a broader industrial strategy. While Mr Trump cited national security and “unfair” foreign competition to justify tariffs on goods like furniture and trucks, he did not explicitly outline a security rationale for the pharmaceutical duty. Notably, a national security investigation under Section 232 was launched in April to review drug and truck imports, suggesting the administration is prepared to defend the tariffs on security grounds if challenged. It remains unclear how the tariff will apply to companies that already have some production in the US but also import drugs – the president’s posts specified exemptions only for plants currently being built.

Mr Trump’s move is the latest salvo in his “America First” trade agenda, intended to pressure drugmakers to produce domestically. The President argues that decades of offshoring have left the US vulnerable and that forcing companies to bring production home will create jobs and secure supply lines. “The reason for this is the large scale ‘FLOODING’ of these products into the United States by other countries,” Mr Trump wrote, referring to the wider tariff package. White House officials point to recent industry responses as validation of the strategy: the mere threat of pharmaceutical tariffs earlier this year prompted many major drug manufacturers to announce new investments in US plants. According to the administration, firms such as Johnson & Johnson, AstraZeneca, Roche, Bristol Myers Squibb, and Eli Lilly have all unveiled plans to expand production in the United States in recent months. The White House has touted these pledges – totalling tens of billions of dollars – as a policy win, claiming credit for “reshoring” critical medicines.

Industry observers note that Mr Trump had initially signalled a gentler approach. In August, he suggested on CNBC that any pharma tariffs would start small and ramp up over time, perhaps increasing gradually to 150% or even 250% over a year or more. Instead, the sudden imposition of a full 100% duty with only a week’s notice caught many by surprise. Even some companies that have committed to build in the US were bracing for a phased plan, not an overnight doubling of import costs. “It’s a shock,” said one pharmaceutical executive privately, noting that constructing new manufacturing facilities can take years and regulatory approvals, raising questions about short-term supply continuity. Nonetheless, firms that have begun U.S. factory projects stand to be exempt. “There will, therefore, be no tariff on these pharmaceutical products if construction has started,” Mr Trump reiterated in his social media posts.

The pharmaceutical industry and health policy experts reacted with alarm and condemnation, warning of dire consequences for patients. The industry’s main lobby, the Pharmaceutical Research and Manufacturers of America (PhRMA), cautioned that sweeping tariffs could backfire. It noted that companies have continued to announce “hundreds of billions in new U.S. investments” under the administration’s pressure, and “tariffs risk those plans”. PhRMA has highlighted that most foreign drug imports come from allied nations and that punitive duties would “thwart industry investment, limit American patients’ access to innovative medicines, and hurt U.S. competitiveness,” disputing any national security basis. A recent analysis by the consultancy EY, commissioned by PhRMA, found that even a 25% tariff on pharmaceuticals would increase U.S. drug costs by almost $51 billion per year and raise prices by up to 13% if passed on to buyers. A 100% tariff, experts say, could be exponentially more disruptive – effectively a price doubling for imported brand-name drugs – potentially leading to shortages or unaffordable costs for some medicines.

Public health advocates are especially concerned about patient access to vital therapies. “Americans would suffer the most if Trump imposes tariffs on pharmaceuticals, as medications would become more expensive and potentially unaffordable,” a coalition of drugmakers warned months ago when the idea was first floated. Those fears intensified after the announcement. “We are already being crushed by the highest prescription drug costs in the world and this will cause them to skyrocket further,” said the advocacy group 314 Action, adding starkly that “if [Trump] goes through with these tariffs, people across the country will die.” Similarly, hospital and insurer groups worry that the tariff will strain healthcare systems. Pascal Chan, vice-president for strategic policy at the Canadian Chamber of Commerce, warned that Americans could face “immediate price hikes, strained insurance systems, hospital shortages, and the real risk of patients rationing or foregoing essential medicines”. These scenarios spell out a public health risk, especially for patients dependent on imported drugs with few domestic alternatives.

Pharmaceutical companies, for their part, have been scrambling to respond. Many multinational drug firms have some US manufacturing capacity – and those with ongoing expansion projects like new factories in North Carolina, Indiana, or Texas – will seek to qualify for the exemption. For example, major insulin and cancer drug producers have announced new US plants in recent months. An Australian biopharma company, CSL, told reporters that it has a “very significant United States manufacturing footprint” already and expects no material impact from the tariffs due to its existing and planned US facilities. However, not all drugmakers can pivot quickly. Generic drug manufacturers operate on razor-thin margins and often rely on overseas supply chains; some warn they may be forced to exit the US market rather than absorb huge new costs. “Higher production cost, including the cost of tariffs, will lead to higher prices… [and] some players can leave the US market… ultimately, the risk is that the US patient will suffer the most,” said Giovanni Barbella, global supply chain head at Sandoz, a major generics producer. There are already persistent drug shortages in the US, he noted, and disrupting global supply links further could exacerbate medicine shortages.

Economists and trade policy experts are parsing the wider implications of Trump’s tariff barrage. By slapping such a high duty on pharmaceuticals – a category in which the US imported nearly $233 billion worth of products in 2024 – the policy could reverberate through the economy. The immediate concern is inflation: pricier drugs would hit consumers’ wallets and could drive up government healthcare spending (Medicare and Medicaid) if insurers pass on costs. “We have begun to see goods prices showing through into higher inflation,” Federal Reserve Chair Jerome Powell warned recently, noting that import costs were contributing to rising prices. Indeed, after a period in which tariffs surprisingly had little impact on consumer inflation, new data indicate that trend may be ending. The timing is delicate – coming as the Fed grapples with inflation slightly above its target and as Trump himself pressures the central bank to cut interest rates. Higher tariffs on drugs (and on commercial vehicles and household items also announced) could add to price pressures, complicating efforts to lower the cost of living even as the President vows to fight “inflation on groceries and everyday goods.”

On Wall Street, the tariff news sent healthcare stocks tumbling amid investor jitters. Shares of pharmaceutical firms across Asia and Europe slid as well. In Tokyo and Sydney, major drugmakers saw their stock prices drop to multi-year lows as markets digested the potential hit to export revenues. An index of biotech companies in Hong Kong fell about 2.5% immediately after the announcement. Analysts called it a “knee-jerk reaction” reflecting uncertainty rather than immediate earnings loss, since many non-US firms may try to mitigate exposure by localising production or rerouting supply chains. But the sell-off underscores how globalised the pharmaceutical industry is – and how a unilateral US tariff can send shockwaves internationally.

America’s trading partners are also uneasy and critical. Japan’s government said it is “assessing the impact” of the new measures and how they square with the U.S.-Japan trade deal. Tokyo’s chief trade negotiator noted that under the bilateral agreement, Japanese exporters are supposed to get “most-favoured nation” treatment on pharmaceuticals, meaning they should not face higher duties than other countries. Officials in Canada and Europe likewise signalled concern. Canada’s Chamber of Commerce blasted the move for endangering patients (as noted) and pointed out that key medicine suppliers like Canada pose no security threat to the US. Mexico, which is the top source of US heavy truck imports, had already formally opposed the truck tariffs during the Commerce Department’s investigation, arguing that Mexican-built vehicles contain ~50% US-made parts. With tariffs now proceeding, Mexican officials worry about supply chain disruptions and have urged diplomatic efforts to avert a tit-for-tat escalation. The US Chamber of Commerce, an influential business lobby, echoed those worries, criticising the new tariffs – especially on trucks – as misguided. It noted that the top five sources of America’s heavy truck imports are “Mexico, Canada, Japan, Germany, and Finland – all allies or close partners… posing no threat to U.S. national security”. That rebuke underscores a broader critique: Trump’s aggressive tariff strategy risks straining alliances and could invite retaliation or legal challenges via the World Trade Organization.

Geopolitically, the pharmaceutical tariff could mark a new front in Trump’s unabashedly protectionist agenda. During his first term (2017–2021), Trump famously waged a tariff-centric trade war against China and imposed tariffs on allies under the guise of “national security” – notably the 2018 25% steel and 10% aluminium tariffs, which roiled transatlantic relations. He also leveraged tariff threats to renegotiate NAFTA (leading to the USMCA deal with Canada and Mexico) and to pressure partners like the EU and South Korea into trade concessions. Now in his second term, the President is doubling down on sector-specific tariffs. Administration officials see them as a versatile foreign policy tool: “Tariffs have [been] a feature of Trump’s second term,” notes Reuters, used to extract concessions and raise revenue, with the Treasury Secretary projecting tariff income of $300 billion by year’s end. The White House has launched over a dozen new investigations into imports of everything from wind turbines and semiconductors to critical minerals, setting the stage for further tariffs. Experts describe this as an unprecedented campaign to weaponise tariffs across multiple industries. In the case of pharmaceuticals, Trump is effectively taking aim at an industry long considered part of the global commons – medicines and medical ingredients flow between countries to where they’re needed. America’s decision to impose a blanket tariff on drugs is thus raising fundamental questions about global health cooperation and supply chain resilience. European and Asian officials, while cautious in public comments, privately worry that such moves could fragment the pharmaceutical trade and complicate joint responses to health emergencies.

Trump’s new tariff on medicines fits a familiar pattern of his administration’s hardball industrial policies, but it also goes further than before. In prior trade actions, Trump often targeted raw materials (like steel, aluminium, copper) or finished goods such as appliances and electronics. This marks the first time life-saving medical products are being hit with triple-digit duties, reflecting an escalation of the President’s “Made in America” campaign. It comes on the heels of other pharma-related directives: in May, Trump signed an executive order to slash regulatory hurdles for domestic drug production, aiming to speed up factory construction and approvals. That executive order was intended to complement the tariff threat, providing carrots (regulatory relief) alongside sticks (import taxes) to coax companies into reshoring. By September, however, the administration opted for the stick in dramatic fashion. The result is that the US now faces the highest average tariff levels since the 1930s, according to economic analyses, a staggering reversal for a nation that championed free trade for decades.

Observers point out that similar tariff-heavy strategies in the past have had mixed results. Tariffs on imported steel and solar panels did bolster certain domestic industries, but they also raised input costs for downstream manufacturers. The trade war with China forced some supply-chain reorientation but led to higher prices for American consumers on many goods. Trump’s defenders argue that, unlike those examples, pharmaceuticals are a strategic sector: bringing drug production home could enhance national security (by reducing dependence on foreign factories for essential medicines, especially in times of crisis) and potentially create high-skilled jobs in manufacturing and biotech. “This will bring the pharmaceutical industry back to American shores,” a senior administration official said, insisting that short-term pain will yield long-term gain. They point to companies like Eli Lilly and Johnson & Johnson committing tens of billions to US operations as proof that the policy is working. Indeed, domestic investment in pharma has ticked up, with new plants and expansions announced in states like Indiana, North Carolina, and New Jersey.

However, critics counter that the costs to patients and innovation may outweigh the benefits. If drug companies earn less on US sales due to tariffs, that could squeeze profit margins and leave less funding for R&D into new cures. PhRMA and bio-industry groups warn that diverting resources to duplicate manufacturing facilities could be inefficient, and ultimately fewer new drugs might come to market if companies must shoulder higher operating costs. Moreover, tariffs do nothing to directly lower drug prices – in fact, they likely raise them. The administration’s approach appears to clash with Trump’s earlier pledges to reduce prescription drug costs for Americans. As one health economist noted, “It’s ironic that a policy purportedly to strengthen American pharma could make medications more expensive and scarce in the short run.” The prospect of prices doubling for some medicines overnight has already set off alarm bells among patient advocacy groups and lawmakers from both parties. Congress has so far been relatively quiet, but pressure may build for legislative relief if patients start feeling the pinch or if stories emerge of essential drugs stuck at ports because importers can’t pay the duty.

Looking ahead, the consequences of this tariff gambit will unfold in the coming weeks and months. The immediate implementation deadline of 1 October means hospitals, pharmacies and distributors are now racing to adjust – whether by stockpiling critical drugs ahead of the tariff or seeking alternative suppliers in the US. Internationally, trade partners will decide whether to negotiate exemptions, retaliate, or challenge the US at the WTO. The Trump administration, true to form, has signalled willingness to negotiate on a country-by-country basis: “If you open your markets and eliminate your barriers, maybe we’ll adjust,” Mr Trump wrote in letters to foreign leaders during earlier tariff talks. In the case of medicines, that could translate to pressure on allies to strike bilateral deals or increase their imports of American-made drugs in exchange for tariff relief.

For now, the new tariff stands as a bold – and contentious – experiment in reshoring a vital industry. Will it jump-start domestic pharmaceutical manufacturing, as intended, and reduce dependency on overseas producers? Or will it result in higher drug prices, supply disruptions, and diplomatic fallout, ultimately harming the very Americans it aims to protect? Those questions loom large. As the 2024 import data shows, the US is deeply entwined with global pharmaceutical trade, and untangling that will not be simple. Mr Trump has compared his tariff strategy to tough medicine: unpleasant but necessary to cure what he sees as an economic ill. The world – and millions of American patients – are now bracing to see if that prescription heals or hurts in the long run.

© 2026 Biopharma Boardroom. All Rights Reserved.